Who Typically Pays For Title Insurance In Texas

In Texas the choice of a title company is freely negotiated between the buyer and the seller. All title agents charge the same premium for property of the same value.

Texas Seller Closing Costs In 2021 How Much Will You Pay

Who pays for title insurance.

Who typically pays for title insurance in texas. If disputes over title ownership arise after the purchase the insurance policy pays for any legal fees to resolve them. Its customary for the lenders policy to be paid by the home buyer. In some states title insurance premiums are the same no matter who you work with.

Who pays for owners title insurance or closing costs. Mortgage lenders also require a title insurance policy. The payment will appear as a sellers contribution to closing costs on the settlement statement.

You only pay the title policy premium once at the closing of the sale. However dont assume that the seller will automatically pay. Title insurance protects the buyer from any financial loss due to issues that arise with the title such as outstanding liens.

The buyer must pay for title insurance expenses related to their loan with their lender in just about every state. If the seller pays for both the owner policy and the lender policy of title insurance then the seller can pick the title company without violating the Real Estate Settlement Procedures Act RESPA. But agents add charges to the premium and the amount of the charges can vary by agent.

In some states the seller pays for the owners title insurance policy as a seller closing cost. As with the owners title policy responsibility for payment is negotiable though it is usually the borrowerbuyer who pays for the loan policy. In Texas the premium includes charges for additional services such as the title search the title examination and closing the transaction.

In the case of the home buyers title insurance policy its customary for the seller to pay the costs of the policy issued to the new homeowner. While this can vary from one transaction to the next it is customary in Texas for the seller to pay for the owners title insurance while the buyer pays for insurance for the lender. Similar to many closing costs these fees can be negotiated between buyer and seller.

Similar to many closing costs these. Title insurance policy forms and endorsements are regulated by the department of insurance. The buyer borrower typically will pay for the Loan Policy.

Typically the Seller pays for the title policy and the buyer pays for the survey in our market Dallas. Unlike other types of insurance that help cover future mishaps title insurance is. Paying for Title Policy in Texas While there are no hard-and-fast rules it is customary for the seller to pay for the Owners Policy.

So who pays for title insurance in texas. Title insurance policy forms and endorsements are regulated by the department of insurance. In Texas the title policy is normally paid for by the seller.

Who pays for the owners title policy in Texas. Typically the seller pays for the title policy and the buyer pays for the survey in our market dallas. In texas it is typically the seller who pays for the cost of the owners title insurance policy issued to the buyer but it is negotiable.

Then a Buyer would pay for a new survey if the existing one is not available or able to be used since he is buying the property. The premium amount for these properties is determined by the sale price of the home. TDI sets title insurance premiums.

The seller pays for the title insurance coverage for the buyer and the buyer pays for the title insurance policy for their lender. Title insurance is a type of insurance that protects mortgage lenders andor homeowners against claims questioning the legal ownership of a home or property ie the title to the property. In the past the seller has traditionally paid for the title policy due primarily to the sellers contractual obligation to pass good title to the purchaser.

Who typically pays for title insurance in Texas. Ask your agent for a list of charges. Both the buyer and seller pay for title insurance but each type is slightly different.

In other states the buyer pays for the owners title insurance policy as a buyer closing cost. The buyer and seller may negotiate who pays the premium. While this can vary from one transaction to the next it is customary in Texas for the seller to pay for the owners title insurance while the buyer pays for insurance for the lender.

It must be negotiated during the offer. What items are included in the title insurance premium rate in Texas. Who pays for the title policy in Texas on new homes.

Is there a way to save money on my closing. This is one of the many reasons why you should be represented by a knowledgeable Realtor in a new home transaction. In general the person selling the property is responsible for paying for the Owners PolicyDetermining who pays for the Owners Policy can be negotiated however and may be partially paid for by the person buying the house.

Texas rates are considered to be all-inclusive premium rates. Of course this is negotiable but some think that the Seller owns the house and should provide clear title etc. While the price of title insurance depends on your home for the Texas median home price of 213036 your title insurance will.

Buyer S Road Map Buyers Roadmap House Styles

How Can I Register My Vehicle In Missouri If I M New To The State And Other Questions Life Insurance Policy Compare Quotes Life Insurance Companies

What Is Earnest Money Home Buying Process Find A Realtor Home Buying

Key Terms To Know In The Homebuying Process Infographic Home Buying Process Home Buying Process Infographic

Tips To Getting Started With Va Home Loans Va Loan Tips Latest Va Home Loan Information Valoan Vatips Valoantips These Were S Home Loans Va Loan Loan

What Are The Seller Closing Costs In Texas Houzeo Blog

Who Pays Title Insurance Costs In Texas Buyer Or Seller Jvm Lending

8 Best Car Insurance Companies In Texas Money

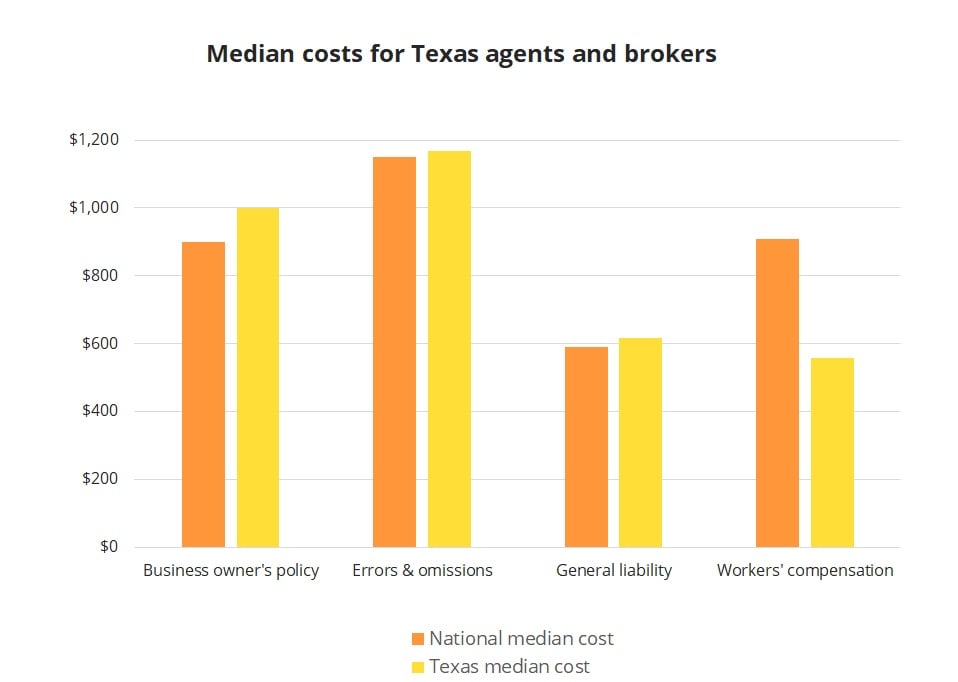

Real Estate Agent Broker Insurance In Texas Insureon

How Much Are Closing Costs For Sellers In Texas

Real Costs Of Buying A Home Real Estate Tips Local Real Estate Home Buying

Sr 22 Insurance In Texas What Is It How Much Does It Cost Valuepenguin

Texas Title Policy Calculator With 2021 Rates Elko

Who Pays Closing Costs In Texas Listingspark

Buying A Home Is One Of The Smartest Purchases You Can Ever Make Knowing What To Expect Along The Journ Home Buying Process Home Buying First Time Home Buyers

Pin On Cheap Car Insurance Quotes For Jeep Compass In Nevada Nv

Post a Comment for "Who Typically Pays For Title Insurance In Texas"