Title Insurance Refinance Same Lender

If youre refinancing your mortgage your Lender will require you to purchase a lenders title insurance policy. As the name suggests this policy protects the lender against losses incurred due to.

One Of The Subjects Which Often Comes Up During A Transaction Is Title Insurance Though Some May Think Title Insurance Homeowners Insurance Coverage Insurance

Yes you will need to buy a new lenders title insurance policy during the refinancing process even if you use the same lender for your new loan.

Title insurance refinance same lender. Basically a borrower can save money any time they refinance. If you bought an owners title policy when you purchased your home you wont need to buy another if you refinance because the coverage lasts as long as you own the home. Heres how it works in Texas.

With the new refinanced loan the original loan will be paid off and the new lender will require protection of its interest for the new loan. Have us quote your closing costs to see how much you can save. When doing a refi check with.

Even if you refinance with the same lender the existing lenders policy terminates when you pay off the mortgage. A refinanced loan is no different than any other mortgage loan. Lenders title insurance owners title insurance title insurance This entry was posted on Thursday February 27th 2020 at 1046 am and is filed under Home Buying Process title TitleYou can follow any responses to this entry through the RSS 20 feed.

While most lenders will require a lenders title insurance policy to be purchased with every loan a common misconception is that the lenders title insurance loan policy will also protect the owner of the property against any title issues. The original lenders title insurance policy protects the lenders interest on the original loan. Therefore when you refinance your lender will require a new loan policy on your new mortgage to protect their investment in the property.

For a refinance the Lender will similarly demand title insurance to cover their interest but no Buyer policy is necessary. If youre satisfied with your current lender that could be enough motivation to refinance with the same lender. Whats included in title insurance costs.

However the lenders title insurance policy doesnt insure the new mortgage created when you refinance. You will likely be required to purchase lenders title insurance each time you refinance or buy a new home. But while the benefits of good customer service are significant youll still want to ensure your existing lender can meet your refinancing goals before you sign on the dotted line.

For a refinance loan the cost of a new lenders title policy is closer to 05 of the loan balance Yohe said. Lenders Title Insurance Lenders Title Insurance is required in nearly all refinance and purchase transactions. Why do I need title insurance when refinancing a mortgage loan.

You can skip to the end and leave a response. However your current owners policy if. From the lenders stand point.

That means that the lender is not protected. Refinancing your mortgage at a lower rate is a great way to save money. When you refinance your home your old loan is paid off and the lenders title policy expires.

The homeowner will still be covered by the title insurance from their purchase. This can result in a significant reduction in the amount you pay for title insuranceup to 40-60. You can extend or reduce the length of the mortgage or apply for a different type of loan.

Ask If Youre Getting the Reissue or Refinance Rate The availability of discounted title insurance rates varies by state but if youve purchased or refinanced a home in the recent past you could be eligible. If your previous loan has not been sold you can refinance with the same lender and only pay the intangible tax on the difference between the current. It is important you know that its your right to choose the Title Insurance Company.

However the homeowner can use their owners title insurance policy when refinancing to receive a reissue credit on the loan policy that would be required by the lender at the time of refinance. Furthermore the lender is concerned about title issues that may have arisen since you purchased the property such as the lien mentioned in an earlier question. The short answer is yes you can refinance with the same bank or lender.

The Title Search Process Title Insurance Homeowners Insurance Insurance

Title Insurance Guide For Shenandoah Valley Realtors

Louisville Kentucky Va Home Loan Mortgage Lender Frequently Asked Questions For Kentucky Va Mortgage Loans Va Mortgage Loans Mortgage Loans Mortgage Lenders

Anatomy Of A Title Commitment Proplogix Title Insurance Estate Law Real Estate Infographic

How Certifid Is Solving One Of The Title Industry S Biggest Problems Proplogix Real Estate Fun Title Insurance Insurance Industry

Good Morning What Is Title Insurance Title Insurance Protects Real Estate Owners And Lenders Against An Title Insurance Indemnity Insurance Insurance Agent

Owners Title Insurance Title Insurance Insurance Marketing Title

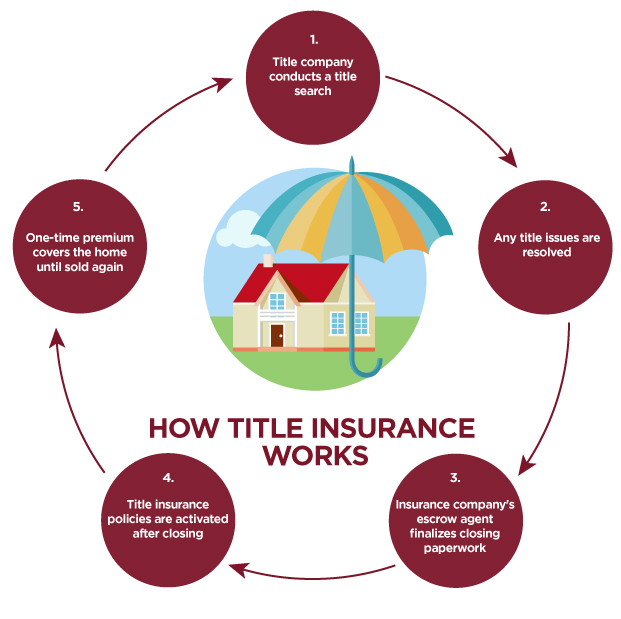

What Is Title Insurance Infographic Title Insurance Life Insurance Facts Mortgage Tips

50 Reasons To Have Title Insurance Title Insurance Flood Insurance Realtor Pinterest

What Is Title Insurance Do You Need To Buy It

The Importance Of An Owner S Title Insurance Policy Title Insurance Insurance Marketing Insurance Policy

Title Insurance Owner S Vs Lender S Policies

Pin On I Love My Career Real Estate

Selling Your Home Title Insurance Explained Title Insurance Real Estate Career Insurance

Ten Shocking Facts About Heloc Heloc Line Of Credit Home Equity Heloc

Is Title Insurance Necessary During A Refinance Landmark Abstract

Title Insurance What You Need To Know Rocket Mortgage

5 Home Buying Nightmares Your Title Insurance Could Prevent Title Insurance Content Insurance Insurance

Post a Comment for "Title Insurance Refinance Same Lender"