How Much Does Owner's Title Insurance Cost In Florida

68 Zeilen The title insurance premiums are regulated by the State of Florida. Up to 100000 575 per 1000.

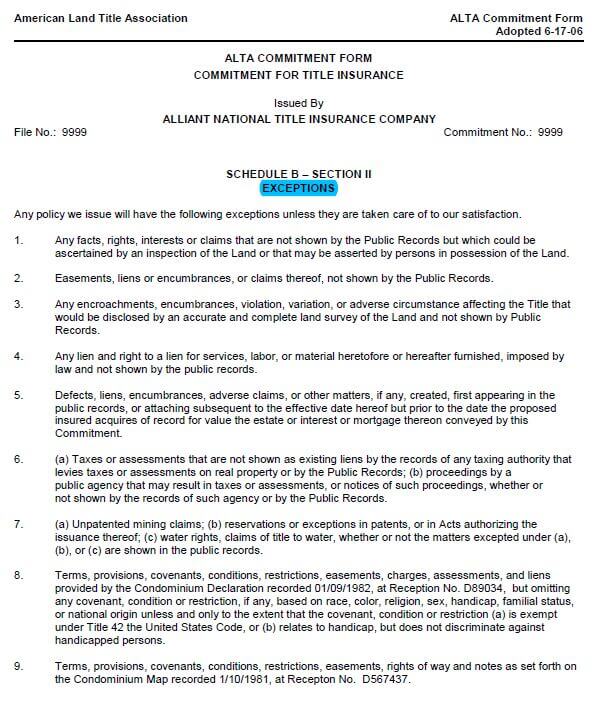

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

232500 Total Premium.

How much does owner's title insurance cost in florida. Florida Title Insurance Rates 0 to 100000. A lenders policy insures the lenders interest in the title to your home. Florida Title Insurance Rates.

Over 100000 to 1 million 500 per 1000. Perhaps this is the part you are most interested in. Free Florida Title Insurance Premium and Fees Calculator.

500 per 1000 1 million to 5 million. The costs involved in filing a quiet title action in Florida include such things as the Court required case filing fee which ranges between 300 and 450 depending on the county in which the case is filed. As long as the lender is protected with a loan policy you are free to go ahead with the closing.

Over 10 million. Keep in mind however having title insurance in place that protects the. The current title insurance rate as determined by the state of Florida is.

225 per 1000. DONT PANIC IF YOU HAVE TO PAY FOR TITLE INSURANCE. The one-time payment is made at the time of settlement.

The fees for title insurance are regulated by the state of Florida making them not unreasonable and about the same no matter which title insurance company you choose. The cost of title insurance does vary depending upon the purchase price of the property. In Florida the title insurance premium is based on a promulgated rate calculation and this rate is determined by the state.

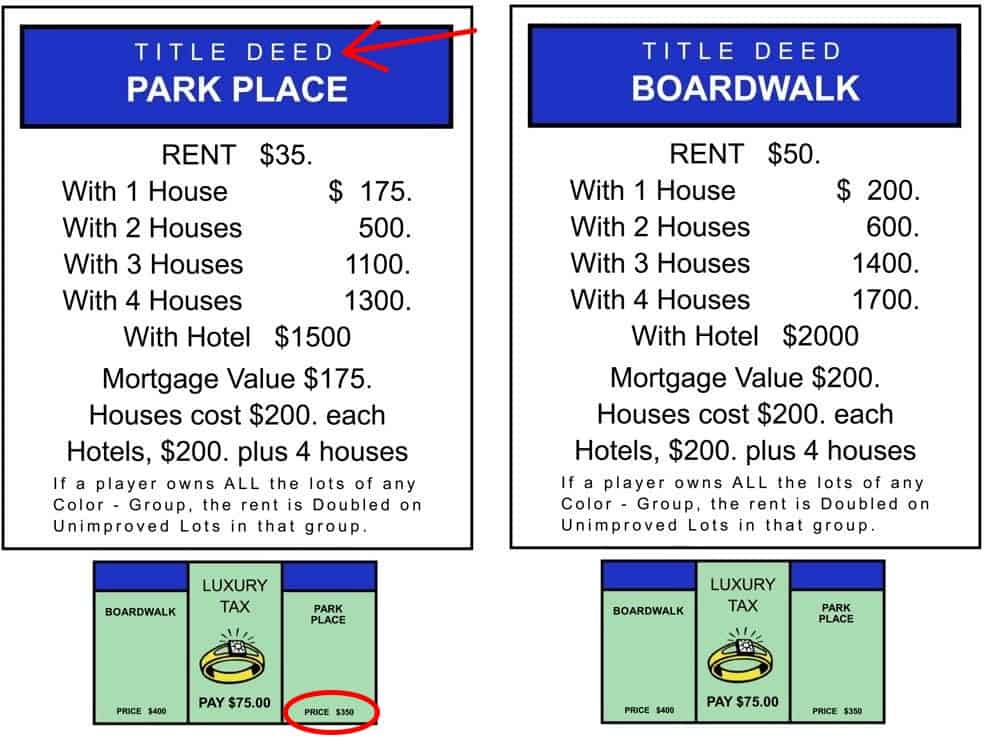

350000 divided by 1000 350 now times that by 500 according to the table above 175000 Total for the additional 35000000 Now add the two totals together to get your owners title insurance premium. However in Florida the average cost is US 1000 for homebuyers. Keep in mind that the state has the power to decide on what the consumer will have to pay or on what the insurer will charge for title insurance.

0 up to 100000 - 575 per 1000 min 100 Over 100000 up to 1 Million - 500 per 1000 Over 1 Million up to 5 Million - 250 per 1000. For the amount over 100000. The fee range translates to a premium of 137250 to 2745 for a median-priced home of 274500 according to December 2019 data from the National Association of Realtors.

How Much Does It Cost. Your lender may require its own title insurance as a condition of your mortgage loan. The price varies from one state to another.

Over 1 million to 5 million 250 per 1000. Title insurance premiums rate calculation in Florida is similar to the millage rate used to calculate property taxes when a specific rate is assigned per each 1000 of the property price. 575 per 1000 min 100 100000 to 1 million.

In Florida documentary stamps are calculated at a rate of 70 with the exception of Miami-Dade county which is 60 per every 100 of the purchase price. Estoppel and HOA Charges If you live within a Homeowners Association then your HOA will charge you to obtain and Estoppel Letter which clarifies the status of your financial obligations to the association if any exist. For the first 100000.

Use this calculator to estimate the title insurance endorsements and title fees offered by Network Closing Services for both the buyer and seller based on the specified sales price and loan amount entered. Aside from the effect on the title insurance policy owners must also consider the additional cost associated with transferring ownership subsequent to the title insurance being issued. Over 5 million to 10 million 225 per 1000.

How much does it cost to quiet a title in Florida. While title insurance costs by state vary the higher your purchase price the more youll likely pay for title insurance. For title insurance is the amount of the sale price of the property.

An owners policy is not required in the state of Florida or in other states as well. The average cost of title insurance is around 1000 per policy but that amount varies widely from state to state and. For example to protect an interest of about 200000 the cost of a title insurance from the property owner will be something between 700 in Maine to 1400 in Florida.

250 per 1000 5 million to 10 million. How much does title insurance cost. In these counties the buyer will pay for title insurance.

The cost of Title Insurance is calculated based on the purchase price of the subject property. In Florida title insurance premiums are computed by a fixed formula set by the State and are directly tied to the price of the property being Sold. There are two primary types of title insurance - a lenders policy and an owners policy.

So the lenders title insurance covers banks and other mortgage lenders from unrecorded liens unrecorded access rights and other defects. Please select your state county order type and enter your sales price andor loan.

Understanding Title Insurance Costs Real Estate Advice

Florida Title Insurance Calculator With 2021 Promulgated Rates Elko

Closing Costs When Paying Cash For A Property Financial Samurai

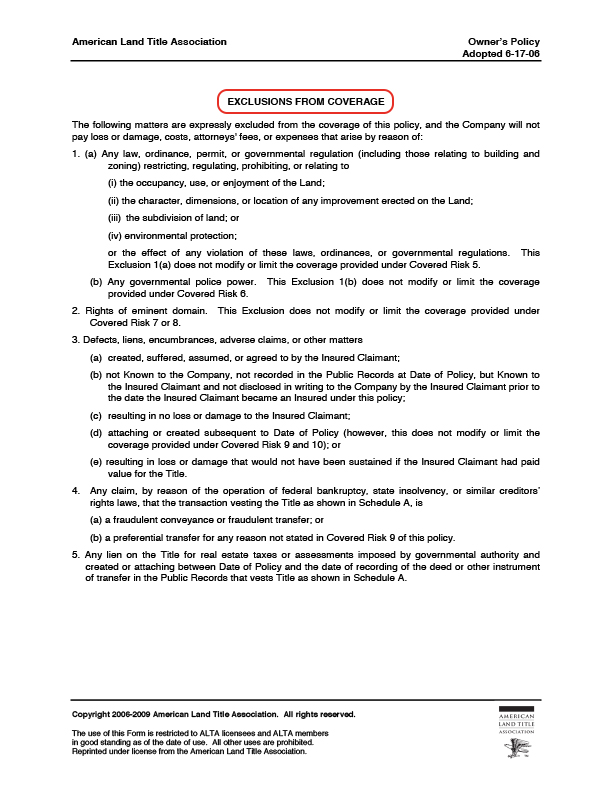

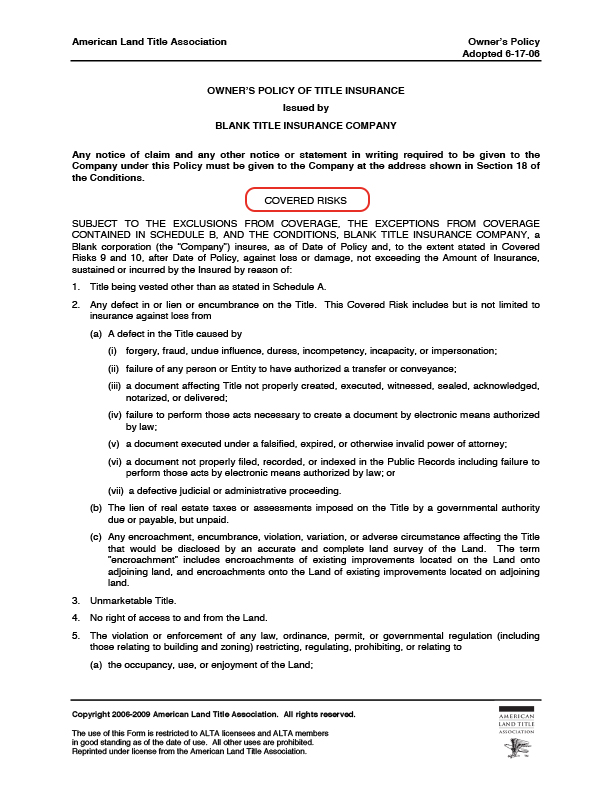

Parts Of A Title Policy Home Closing 101

Parts Of A Title Policy Home Closing 101

So What Is Title Insurance Florida S Title Insurance Company

Title Search Vs Title Report Vs Title Insurance Title Partners Of South Florida

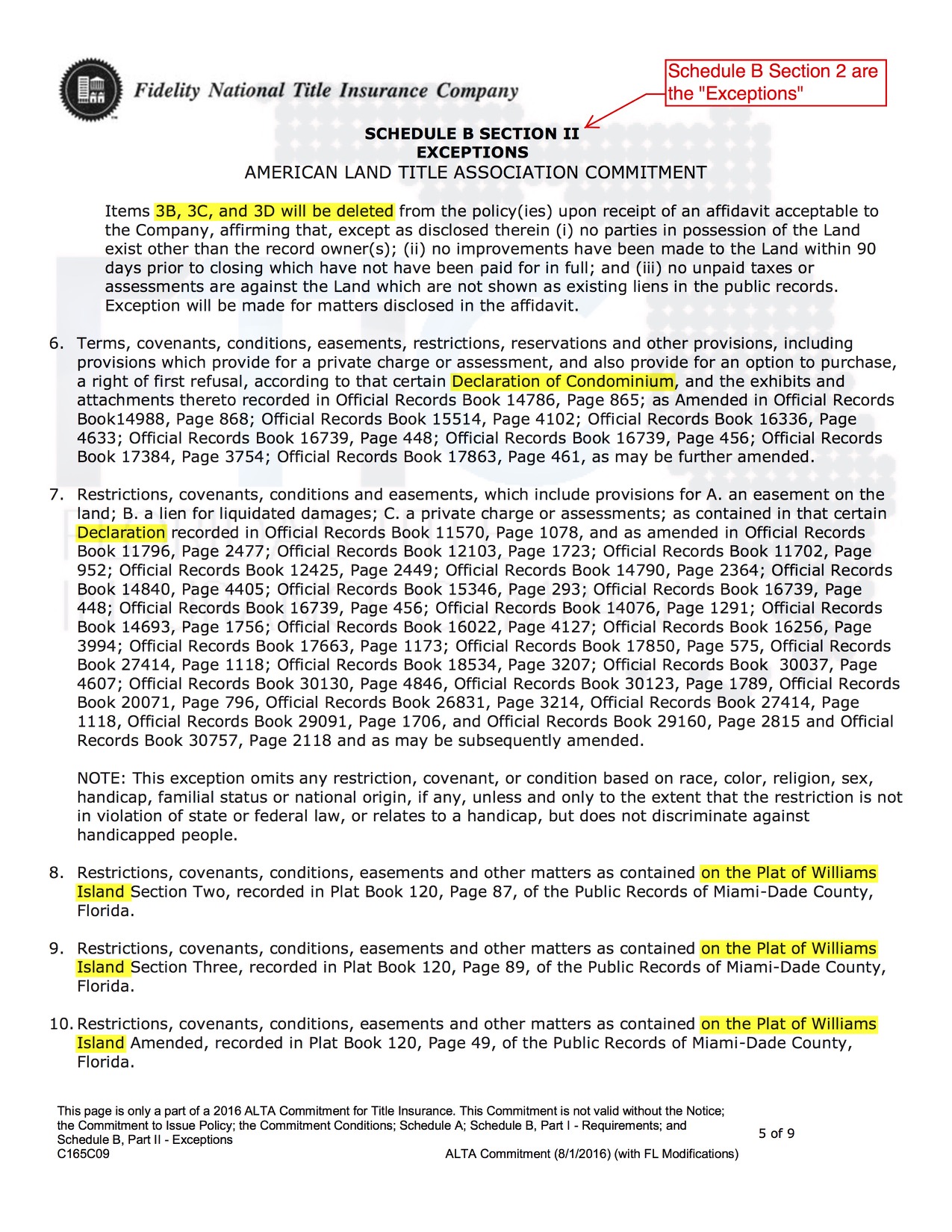

How To Read A Title Commitment Florida S Title Insurance Company

How To Read A Title Commitment Florida S Title Insurance Company

Parts Of A Title Policy Home Closing 101

How To Read A Title Commitment Florida S Title Insurance Company

Parts Of A Title Policy Home Closing 101

How To Read A Title Commitment Florida S Title Insurance Company

Understanding Title Insurance Costs Real Estate Advice

And The Survey Says Who Pays For Title Insurance By County

Buyer Or Seller Who Pays For Closing Costs And Title Insurance

How To Read A Title Commitment Florida S Title Insurance Company

Post a Comment for "How Much Does Owner's Title Insurance Cost In Florida"