Life Insurance With Long Term Care Rider Quote

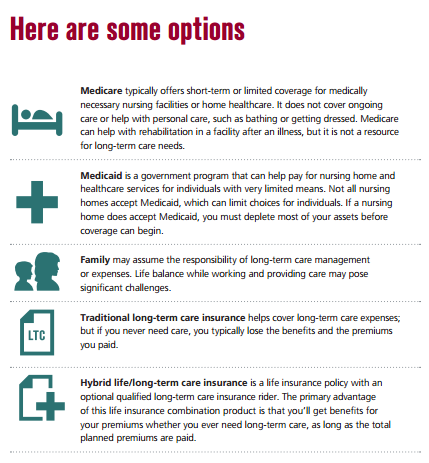

Including the long term care rider with your life insurance policy may help reduce the financial responsibility of your family and friends to provide for you as you age. Life Insurance with Long Term Care Riders are also referred to as Asset Based Long Term Care plans.

Top 10 Best Long Term Care Insurance Companies

This puts employees on notice that they have a very short window to buy long-term care insurance.

Life insurance with long term care rider quote. Premiums invested are not lost if you do not use the insurance. Learn more about long term care coverage. This is one of the most expensive riders to add to your insurance policy.

Stand-alone long-term care insurance rates vary depending on applicants ages and conditions levels of benefits and the company. A hybrid LTCI policy is a type of asset based long-term care insurance. Read more to find out everything you need to know about long-term care riders.

An employee who attests that the employee has long-term care insurance purchased before November 1 2021 may apply for an exemption from the premium assessment under RCW 50B04080. Here are some ways they differ from traditional long term care insurance. Life Insurance with an Accelerated Death Benefit Rider which can be used for qualified long term care needs.

For single female its 2700. Because your payments are being used to fund a few. LTC premiums average about 2700 annually or 225 per month a cost that many may not be able to afford.

The added benefit is that they can transfer assets tax free to your. Using the example from above the policy would reserve 25000 for the death benefit and use 475000 for the long-term care benefit. The AALTCI said the average LTC rate for a single male age 55 is about 2050 annually.

Each companys policy offers unique benefits and it is difficult to know which combination long term care life insurance company or stand alone will be the best choice for you. The death benefit can then be used to pay for long-term care expenses. Combination Long-Term Care and Life Insurance.

A long-term care LTC rider is a life insurance policy feature that allows you to receive a portion of the death benefit while you are still alive. Life insurance with long-term care riders can continue to provide benefits until the face value of the policy is exhausted but will reserve a portion to provide an actual death benefit. You pay for a defined period of time and it offers a money-back guarantee.

It combines life insurance or an annuity with a long term care insurance rider. These plans havent been around for long but they are getting popular fast. According to the American Association for Long-Term Care Insurance 84 of long-term care.

Life Insurance with Long Term Care Riders protect your assets from long term care costs. Opting Out of The Washington State Long-Term Care Tax. To qualify for the rider you must be unable to independently perform two of the.

Its just accelerating your death. Monthly allowed amounts vary but could range from 1 to 4 of your death benefit. Each long term care insurance company below offers either a linked benefit combination policy life insurance with long term care rider or a stand alone long term care insurance policy.

In this case if the insured needs in-home care or nursing home care they pull the money from their life insurance policy and it reduces their death benefit. This rider is typically sold as a separate product. This is our most versatile long-term care solution because it gives you long-term care coverage if you need it life insurance if you dont or a little of both.

The average LTC rate for a couple both age 55 is close to 3050. If you qualify for the long-term care benefit via your LTC rider your life insurer may distribute up to the allowed amount which may be set as a lump sum or as a percentage of your policys death benefit each month. A long-term care rider is designed to help you cover the costs of long-term care should you be unable to take care of yourself due to illness or disability.

2 Age location plan features and. In other words no new money is being created here so its not actually LTC coverage. With this type of benefit called an indemnity style rider you dont need to submit bills and receipts each month.

So if you have a 250000 life insurance policy the most youd be able to take out for long-term care if you have the rider is 200000 if your insurance company allows 80. The death benefit would be 174000 based on a quote provided by Newman Long Term Care. That provides long term care benefits for nearly 4 years.

Can A Nursing Home Take Your Life Insurance Fidelity Life

A New Approach To Long Term Care Insurance Long Term Care Insurance Long Term Care Insurance

Top 10 Best Long Term Care Insurance Companies

Life Insurance Riders Endorsement Accuquote

Top 10 Best Long Term Care Insurance Companies

Long Term Care Insurance Moorestown Cranford Nj Senior Advisors

Usaa Long Term Care Insurance Cost And Review June 2021

Insurance Management Corporation Long Term Care Insurance

Life Insurance Riders Endorsement Accuquote

Top 10 Best Long Term Care Insurance Companies

Top 10 Best Long Term Care Insurance Companies

Top 10 Best Long Term Care Insurance Companies

Top 10 Features Your Long Term Care Insurance Policy Should Have Get The Most Out Of Your Life And Health Insurance Long Term Care Insurance Infographic Health

Top 10 Best Long Term Care Insurance Companies

Usaa Long Term Care Insurance Cost And Review June 2021

Post a Comment for "Life Insurance With Long Term Care Rider Quote"